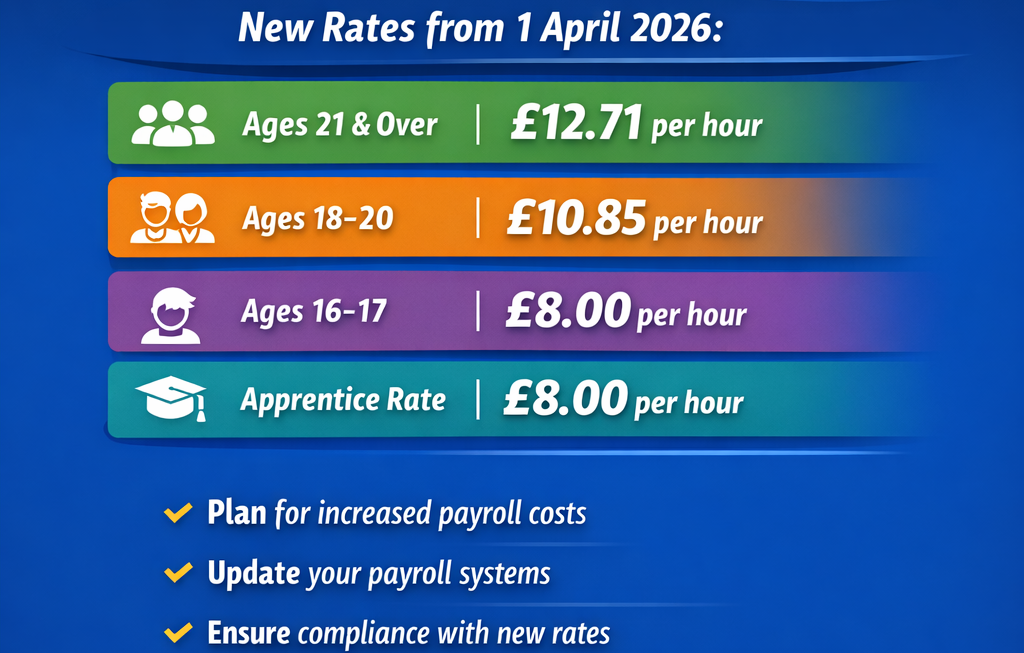

New UK Minimum Wage Rates from 1 April 2026

From 1 April 2026, the UK government is introducing further increases to the National Living Wage (NLW)[…]

Tax-Free Rental Income in the UK – What You Need to Know About the Rent a Room Scheme

The UK tax system offers several legitimate opportunities to increase your income while remaining compliant with HMRC.[…]

How to Legally Reduce Tax in the UK – Smart Strategies Used by Accountants

How to Legally Reduce Tax in the UK – Smart Strategies Used by Accountants Reducing tax legally[…]

Starting a Business in the New Year – Turning Resolutions into Reality

The beginning of a new year is often a time for reflection, fresh ideas, and new goals.[…]

Making Tax Digital in the UK: What Businesses Need to Know

Making Tax Digital (MTD) represents one of the most significant modernisations of the UK tax system. Introduced[…]

Payroll and Pensions – Employer Responsibilities in the UK

Employers in the UK face a wide range of legal obligations when it comes to payroll and[…]

When You Must File a Self Assessment Tax Return in the UK

If you receive income in the UK outside of your regular employment (income on which tax has[…]

Why Bookkeeping is the Backbone of Every Successful Business

When running a business, it can be tempting to focus all your energy on sales, marketing, and[…]

Verifying Your Identity for Companies House: What You Need to Know

In the UK, new rules are being introduced requiring individuals who set up, run, own, or control[…]

What Documents and Filings Must a Director or Owner of a UK Limited Company Submit?

Operating a limited company in the UK comes with a range of legal and financial responsibilities. Company[…]